Below we summarize the most relevant tax aspects in the tax reform bill, that was sancionated by President Petro.

- INCOME TAX FOR LEGAL ENTITIES

- A minimum tax is established for income tax taxpayers other than individuals, members of the special tax regime and foreign entities with no residence in the country. It is an alternative method from the ordinary method for calculating taxable income, and it is necessary to calculate the tax using both methods, to then select the one that yields the highest tax amount. This minimum rate is called the “Cleansed” (Depurada) Tax Rate (CTR), which must not be lower than 15%, and it is calculated by dividing the Cleansed Tax (CT) over the Cleansed Profit (CP), as follows:

CTR= CT/CP

In turn, the Cleansed Tax (CT) and the Cleansed Profit (CP) are calculated as follows:

CT=NIT+TDC−ITP

- CT: Cleansed Tax.

- NIT: Net Income Tax.

- TDC: Tax credits or discounts from applying double taxation avoidance agreements and the provisions of article 254 of the Tax Statute.

- ITP: Income tax on income from passive investments in controlled companies abroad. It is calculated by multiplying the net income from passive investments by the general rate of article 240 of the Tax Statute (net income from passive investments x general rate).

CP=PTP+PDITI− INTICP−IEM− NCGI−EI−O

- CP: Cleansed Profit.

- PTP: Financial or accounting pre-tax profit.

- PDITI: Permanent differences established by law that increase net taxable income.

- INTICP: Income that is neither taxable income nor capital gains that affects financial or accounting profit.

- IEM: Income from the equity method for the respective tax year.

- NCGI: Net capital gains income that affects financial or accounting income.

- EI: Exempt income from application of double taxation avoidance agreements – CAN, income earned under the Colombian Holding Company regime (CHC) and the exempt income defined in subsections a) and b) of section 4 and section 7 of article 235-2 of the Tax Statute.

- O: Offsetting amounts of tax losses or excess amounts of presumed income filed during the tax year and that did not affect the financial or accounting profits of the period.

Whenever the Cleansed Tax Rate (CTR) is less than 15%, the amount of the Additional Tax (AT) must be calculated to reach the 15% rate as follows:

- For taxpayers that are subject to this article and article 240-1 of the Tax Statute, and whose financial statements are not subject to consolidation, the Additional Tax (AT) that must be added to the income tax is the positive difference between the Cleansed Profit (CP) multiplied by 15% less the Cleansed Tax

(CT).AT=(CP∗15%)−CT

- The following procedure applies to taxpayers that are tax residents in Colombia and whose financial statements are subject to consolidation in Colombia:

- Calculate the Cleansed Tax Rate of the Group (CTRG) by dividing the sum of the Cleansed Tax (ΣCT) of each taxpayer with fiscal residence in Colombia whose income statements are subject to consolidation, into the sum of the Cleansed Profits (ΣCP) of each taxpayer with fiscal residence in Colombia whose income statements are subject to consolidation, as follows:

CTR𝐺= ΣCT/ΣCP

- If the result is less than 15%, the Additional Tax for the Group (ATG) must be calculated as the difference between the sum of the Cleansed Profits (ΣCP) multiplied by 15%, less the sum of the Cleansed Taxes (ΣCT) of each taxpayer whose financial statements are consolidated, as follows:

AT𝐺=(ΣCP∗15%)−ΣCT

- To calculate the Additional Tax (AT) of each taxpayer with tax residence in Colombia, multiply the Additional Tax for the Group (ATG) by the percentage calculated by dividing the Cleansed Profit of each taxpayer with Cleansed Profit greater than zero (CPβ) over the sum of Cleansed Profits of the taxpayers with Cleansed Profits greater than zero (ΣCPβ), as follows:

𝐴T=𝐴T𝐺 × (CP𝛽/ΣCP𝛽)

- Limits are established for certain tax credits and special deductions, and a limit was placed on exempt income equivalent to 3% of the taxpayer’s ordinary net taxable income. This implies that limits are placed on tax credits such as: donations, environmental improvement investments, and other exempt income.

- The income tax rate that applies to publishing companies incorporated in Colombia as legal entities, and whose economic activity and registered corporate purpose is exclusively related to book publishing, in the terms of Law 98 of 1993, will be 15%.

- Regarding free trade zones, starting in 2024, industrial and service users will calculate net taxable income as follows:

-

- A 20% income tax rate will apply proportionally to net taxable income, with the proportion calculated as follows: revenues multiplied by the result of dividing revenues derived from the export of goods and services over total revenues for tax purposes, excluding capital gains.

-

- The general rate of article 240 of the Tax Statute will apply proportionally to net taxable income, with the proportion calculated as follows: revenues multiplied by the result of dividing revenues other than those derived from exports of goods and services over total revenues for tax purposes, excluding capital gains.

-

- The income tax will be the sum of the resulting amounts of items 1 and 2 above.

The above only applies to industrial free trade zone users that in tax years 2023 or 2024 submit an internationalization and annual sales plan that establishes maximum targets of net revenues of any type from the national customs territory and for revenues earned by the industrial user other than from the performance of the activity for which it received authorization, recognition or qualification, during the corresponding tax year.

To this end, they must sign an agreement with the Ministry of Commerce, Industry and Tourism for each tax year.

In the event no agreement is signed or that the maximum revenue targets are exceeded, the income tax rate will be thirty-five percent (35%).

- Free trade zones devoted to health services and to the development of infrastructure related to airports will be treated as exporters.

- A surcharge is established for the financial sector for tax years 2023 to 2027 equivalent to five percent (5%), for companies whose net taxable income is greater than 120,000 UVT (acronym in Spanish for Tax Value Units) (equivalent to COP 5,040,000,000), which will be subject to prepayment of 100%.

- A surcharge is established for the hydroelectric sector for tax years 2023 to 2026 equivalent to three percent (3%), for companies whose net taxable income is greater than 30,000 UVT (equivalent to COP 960,000,000), which will be subject to prepayment of 100%.

This surcharge cannot be passed on to the end users, considering the established competition regime for each stage of the electricity public utility service value chain. The Energy and Gas Regulatory Commission (CREG, by its acronym in Spanish) will establish regulations on this matter, and the Superintendence of Household Public Utility Services will perform inspection and oversight within the scope of its powers.

- The following surcharge will apply to the hydrocarbons and mining sector:

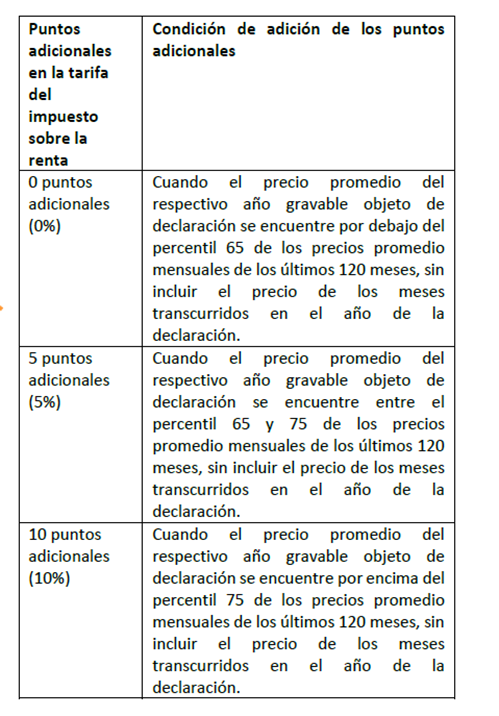

1. Hard coal mining (ISIC – 0510) and lignite mining (ISIC – 0520), as follows:

The prices to be used in the above table for the economic activities of hard coal mining (ISIC – 0510) and lignite mining (ISIC – 0520) are those of the average international coal price benchmark API2, minus freight costs BCI7 (API2 – BCI7) in USD/Ton, deflated by the Consumer Price Index for all urban consumers in the United States of America, as published by that country’s Bureau of Labor Statistics.

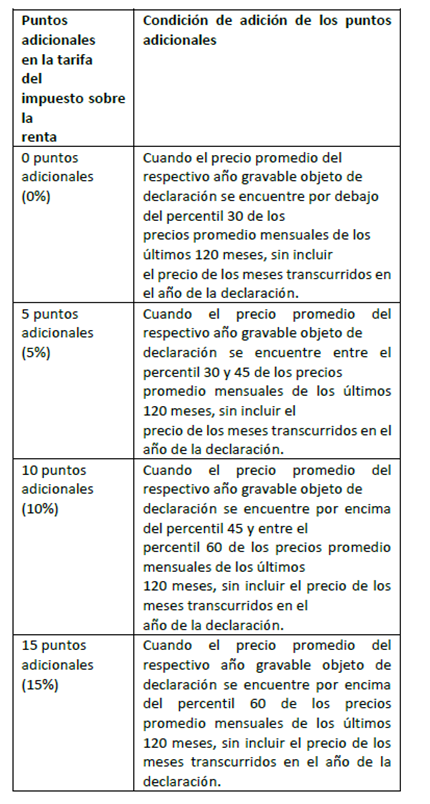

2. Crude petroleum extraction (ISIC – 0610), as follows:

- The consideration the mining and hydrocarbons sector must pay as royalties will not be deductible for income tax effects.

- Local companies and their equivalents, permanent business establishments of foreign entities and foreign legal entities with or without residence in the country will be taxed at a rate of fifteen percent (15%) on income earned in the provision of hotel and eco-tourism and/or agro-tourism theme park services, over a period of ten (10) years, counted from the date when such services begin to be provided at:

-

- Newly built hotels and eco-tourism or agro-tourism theme parks, or

-

- Hotels and eco-tourism or agro-tourism theme parks that have been remodeled and/or expanded, whenever such remodeling or expansion is equivalent to at least fifty percent (50%) of the cost of acquisition of the remodeled and/or expanded property, in accordance with the rules of article 90 of this Statute.

- Personnel expenses of workers who provide support at homes or who perform activities other than the income-producing activity, and the personal expenses of the shareholders, partners, owners of equity interests, clients and/or their families, will not be deductible for income tax effects.

- Companies can no longer make conditioned contributions to pension funds.

- The tax credit for investments made in research, technological development or innovation will be as follows: Those who make investments in projects classified by the National Council of Tax Benefits in Science and Technology in Innovation as research, technological development or innovation projects, according to the criteria of said Council, will have the right to deduct from their income tax payable an amount equivalent to 30% of the amount invested in said projects in the tax period during which the investment was made.

The costs and expenses that give rise to this tax credit cannot be capitalized and cannot be subsequently included as a cost or deduction by the same taxpayer.

- The capital gains rate for companies will be fifteen percent (15%).

- The concept of effective tax residence was changed, and now it establishes that in order to determine management’s effective tax residence all relevant facts and circumstances must be taken into consideration, particularly relating to the place where the company’s or entity’s managers usually perform their duties and where the day-to-day activities of the company or entity are carried out.

- TAX ON DIVIDENDS

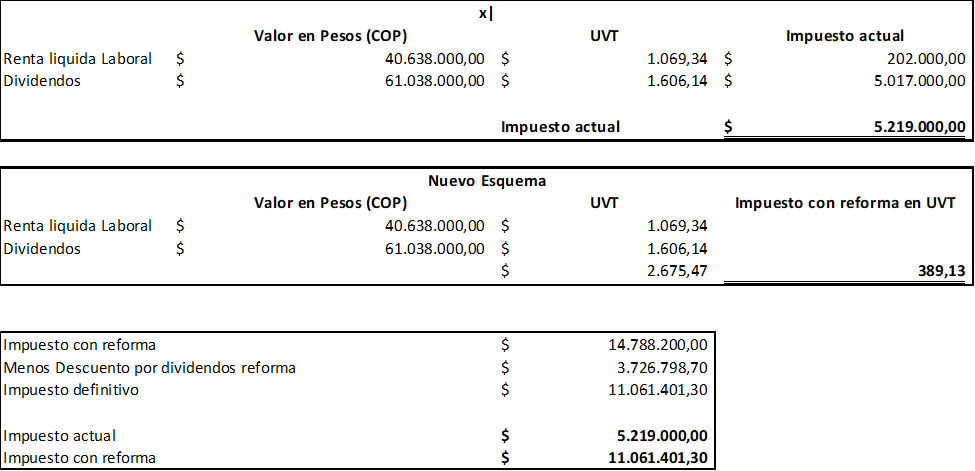

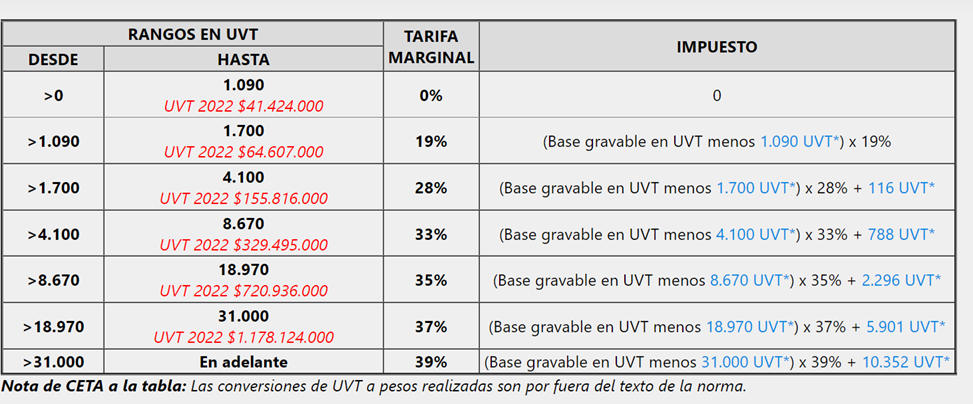

- For individuals who are tax residents in Colombia, the net taxable income reported under the tax category of dividends from profits that were reported as non-taxed, in accordance with article 49 of the Tax Statute, will be added into the general tax category, and a progressive rate will apply, as indicated in the following table:

Once the tax has been established, after having added work-related income, pensions and dividends, a credit on the total calculated tax is granted, determined as follows:

- Net taxable income of the dividends and equity interests tax group in UVT less 1,090 UVT) x 19%

This arrangement maintains the assumption that all types of income continue to be added for the effects of quantifying the income tax, and a tax credit is granted when income from salaries is greater than declared dividends. In this case, the tax on dividends increases.

To illustrate the above, we present the following example:

An individual has a salary of COP 5.2 million per month and receives annual dividends of COP 61.038.000.

- The withholding tax on dividends will be fifteen percent (15%), where the first 1.090 UVT will be exempt from tax withholdings.

- For foreigners, the tax rate and withholding rate on dividends will be twenty percent (20%).

- For foreigners with residence in a country with a current Double Tax Avoidance Agreement (DTAA), dividends will be subject to the provisions of the agreement.

- The withholding rate when distributions are made to local companies was increased to ten percent (10%), and it is transferrable to the withholding made by the company on the final investor.

- Payments of dividends in shares or any other company rights that imply capitalization will be subject to standard and ordinary taxation.

- CERTAIN CHANGES TO SIGNIFICANT ECONOMIC PRESENCE

- This regime becomes effective as of January 1, 2024.

- Foreigners with “significance presence” in Colombia will be taxed. In practice, this is the manner in which the government expects to tax platforms such as UBER, Netflix, HBO, Google and Facebook, but it may include other entities that fit the description, such as large suppliers of goods imported by Colombian residents, for example, Amazon.

- Revenues from a national source are considered to be revenues derived from the sale of goods and/or provision of services by non-resident individuals or entities whose domicile is not in the country and that have significant economic presence in Colombia, to clients and/or users located in the national territory.

- Significant economic presence is defined as meeting any of the following parameters:

-

- For the commercialization of goods, a non-resident individual or entity without local domicile is defined as having significant economic presence in Colombia when:

1.1 Deliberate and systematic interactions are maintained in the Colombian market, i.e., with client(s) and/or user(s) located in the national territory, and

1.2 During the previous or current tax year it has obtained gross revenues of thirty-one thousand three hundred (31,300) UVT or more from transactions involving the sale of goods to client(s) and/or user(s) located in the national territory.

- In the case of the provision of digital services from abroad, those who meet any of the following criteria will be subject to income tax, without having to fulfill the conditions of any of the previous subsections:

2.1 Online advertising services.

2.2 Digital content services, either online or downloadable, including mobile applications, e-books, music and films.

2.3 Free broadcasting services, including television shows, films, streaming, music, multimedia broadcasting, podcasts and any form of digital content.

2.4 Any form of monetization of information and/or data of users located in the national territory and that has been generated by the activities of such users in digital markets.

2.5 Online intermediation services platforms.

2.6 Digital subscriptions to audiovisual media including, among others, news, magazines, newspapers, videos and games of any type.

2.7 Administration, management or processing or electronic data, including web storage, online data storage, file exchange services or cloud storage.

2.8 Online search engine licenses or services, standard or automated, including customized software.

2.9 Online educational services.

2.10 Provision of distance learning or training.

2.11 Provision of the rights to use or to exploit intangible assets.

2.12 Other electronic or digital services aimed at users located in the national territory.

2.13 Any other service provided through a digital market aimed at users located in the national territory.

- The non-resident individuals or entities without domicile in Colombia referred to in this provision may choose to file and pay through the income tax form a rate of three percent (3%) on the total gross revenues derived from the sale of goods and/or provision of digital services from abroad, that are sold or provided to users located in the national territory. In this case, the provisions of article 594-2 of the Tax Statute will not apply, because the tax returns will be deemed to have been validly filed in these cases. When a non-resident individual or entity without domicile in Colombia selects this mechanism, it may request non-application of the 10% tax withholdings.

- The payments or transfers to account arising from the sale of goods and/or provision of services to clients and/or users located in the national territory by non-resident individuals or entities with significant economic presence in Colombia and whose domicile is not in the country, that do not fulfill the other parameters of this article, will be subject to a rate of ten percent (10%) over the total value of the payment.

- In the case of tax withholdings, the following will act in the capacity of withholding agents: entities that issue credit or debit cards, vendors of prepaid cards, those who collect cash on the account of third parties, payment gateways, the withholding agents described in article 368 of the Tax Statute and others designated by DIAN.

- Foreigners that are tax residents in a country with a currently valid DTAA will be governed by the provisions of that DTAA.

- INCOME TAX FOR INDIVIDUALS

- The exemption on work-related income will be twenty-five percent (25%), but the value limit will decrease substantially, as it will no longer be 2,880 UVT (COP 109,448,640) per year, but 790 UVT (COP 33.496.000) per year, i.e., COP 2.791.333 per month.

- The top limit for exempt income and tax deductions for all tax categories is forty percent (40%), and the amount limit is 1,340 UVT (56,816,000).

- Up to 72 UVT per year (COP 3,052,800) can be deducted from the above limit for dependents, up to a maximum of four dependents, without prejudice for the deductions established in section 2 of article 387. Consequently, our understanding is that this is not an additional deduction, because it uses the expression “without prejudice.”

- Individuals who report revenues under the general tax category, and who acquire goods and/or services, may request an income tax deduction, independently of whether or not it has a causal relationship with the taxpayer’s income generation activity, of one percent (1%) of the value of the acquisitions, up to a maximum of two hundred forty (240) UVT (COP 10,176,000) during the respective year, as long as the following requirements are fulfilled:

-

- The acquisition of the good and/or service has not been requested as a cost or deduction from income tax, as an offset for value added tax (VAT), as revenue that is neither taxable income nor capital gains, as exempt income, as a tax credit or as any other type of tax benefit.

-

- The supporting document of the acquisitions of the goods and/or services is a previously validated electronic sales invoice that identifies the acquirer with first and last names, the tax ID number (TIN) or identification document number, and it complies with all other requirements for said invoicing system.

-

- The electronic sales invoice has been paid for using a credit or debit card or any other electronic means processed by an entity supervised by the Financial Superintendence or its equivalent, within the tax year for which the deduction described in this section is requested.

-

- The electronic sales invoice has been issued by a person or entity that is required to issue such invoices.

- Work-related and non-work related income, capital income, pensions and dividends will be added and will be subject to a single progressive rate defined in article 241 of the Tax Statute, and capital gains will no longer be included in this tax group:

- Item 3 of the second paragraph of article 387 was amended: the maximum age for a taxpayer’s dependent children with physical or psychological disabilities is no longer 23 but 18 years old.

- It is no longer necessary to certify that a self-employed person does not have two or more employees in order for the lower withholding rate of article 383 of the Tax Statute to apply; it will suffice to certify that it is work-related income not derived from a formal employment contract or relationship for this method to apply.

- The capital gains rate will be fifteen percent (15%), except winnings from lotteries and raffles, to which a thirty five percent (35%) rate will apply.

-

- Exemptions on capital gains are reduced as follows:

-

- Exempt income from life insurance policies was reduced to 3,250 UVT (COP 137,800,000).

- The tax exemption on profits from the sale of a house or apartment effectively used for housing is reduced from 7,500 UVT (COP 318,090,000) to 5,000 UVT (COP 212,060,000). (This exemption will now apply to all housing, rather than to homes within a certain price range.)

For income tax effects, in-kind payments to third parties must be reported as income in favor of the beneficiary, at market prices, in the case of payments made by the payer to third parties for the provision of services or the acquisition of goods that are to be used by the taxpayer or his/her spouse, or his/her relatives up to the fourth degree of consanguinity, second degree of affinity and up to the first degree of civil relationship, whenever it does not represent own income earned by such persons and excluding the contributions that employers are legally required to make to the Comprehensive Social Security System, the Colombian Family Welfare Institute (ICBF, by its acronym in Spanish), the National Learning Service (SENA, by its acronym in Spanish) and the Family Compensation Funds.

- DECLARING ASSETS HELD ABROAD

The exemption from the requirement to declare assets held abroad when their value is less than 2,000 UVT (COP 76,008,000) was revoked; now all assets held abroad worth more than one peso (COP 1.00) must be declared.

- TAX ON EQUITY

- A permanent tax on equity is established for the following persons:

-

- National or foreign individuals and non-settled estates that are taxpayers of the income tax or alternative tax regimes.

- National or foreign individuals that are not residents in the country, in connection with their net assets held directly in the country, with the exceptions established in international treaties and in national law.

- National or foreign individuals that are not residents in the country, in connection with their net assets held indirectly through permanent establishments in the country, with the exceptions established in international treaties and in national law.

- Non-settled estates of deceased persons who were not residents in the country at the time of their death, in connection with their net assets held in the country.

- Foreign companies or entities that do not file income taxes in the country and that hold properties located in Colombia other than shares, accounts receivable and/or portfolio investments pursuant to article 2.17.2.2.1.2 of Decree 1068 of 2015 and article 18-1 of this Statute, such as real estate properties, yachts, boats, works of art, aircrafts or mining or petroleum rights. Companies or foreign entities that do not file income taxes in the country and that have signed financial lease contracts with entities or individuals that are residents in Colombia will not be subject to the tax on equity.

- Local companies will not be subject to this tax.

- The taxable event will be holding net assets of more than three billion pesos (COP 3,000,000,000)

- The annual rate will be 0.5% on net assets of more than three billion and less than five billion.

- The annual rate will be 1% if net assets are equal to or more than five billion.

- The rate for net assets equal to or more than COP 10 billion will be 1.5% for the first four years, after which the rate will return to 1%.

- It will accrue as of January 1 each year.

- A deduction may be made for the house or residence where the taxpayer effectively lives, for up to 12,000 UVT (COP 508,800,000); this does not include recreational homes, second homes or other types of real estate properties.

- Changes were made to the value of shares, which must now be reported as follows:

- The value of shares or equity interests in national companies or entities that are not listed on the Colombian Securities Exchange or in a recognized qualified international entity as defined by the Special Administrative Unit (UAE, by its acronym in Spanish) of the National Tax and Customs Administration (DIAN, by its acronym in Spanish) will be the tax cost determined in accordance with the provisions of Title II of Book I of this Statute, updated each year in accordance with the provisions of article 73 of the Tax Statute for shares or equity interests from the date on which they were acquired. Shares or equity interests acquired before January 1, 2006 will be deemed to have been acquired in 2006.If the amount calculated according to the above rule is greater than the carrying amount of the shares, the latter value will be used. The carrying amount is calculated by dividing the carrying value of equity as of January 1 each year by the number of shares or parts of equity interest outstanding.

- In the case of shares or equity interests in national companies or entities listed on the Colombian Securities Exchange or in a recognized qualified international entity as defined by the UAE of the National Tax and Customs Administration (DIAN), the value will be the average price quoted on the market during the year or fraction of the year previous to the date on which the tax accrues. The treatment defined in items 1 and 2 will apply to determine the tax value of rights in investment vehicles such as mercantile trust funds or collective investment funds whose assets are comprised of shares or equity interests in national companies or entities, in accordance with article 271-1 of the Tax Statute, to the extent that it is not inconsistent with these items.

- Parts of interest in private interest foundations, trusts, insurance with a material savings component, investment funds or any trust business abroad, will receive the same treatment as trust rights, and in this case the provisions of articles 271-1 and 288 of the Tax Statute will apply.

To these effects, when the beneficiaries are conditioned or do not have control or capacity to dispose of the underlying assets, the founder, constituent or originator or the assets transferred to the private interest foundation, trust, insurance with a material savings component, investment fund or other trust business, will be the party required to file the tax on equity. The above is independent from the discretional, revocable or irrevocable nature, and independent from the powers of the protector, investment advisor, investment committee or irrevocable powers of attorney granted to the trustee or a third party.

In the event of the death of the founder, constituent or originator, such assets will be reported by the non-settled estate, until when the beneficiaries receive the assets, to which end the intermediate companies created for such purpose will not be recognized for tax effects. In the event the identity of the founder, constituent or originator cannot be determined, or the estate has already been settled, the direct or indirect beneficiaries of the assets will be the ones required to file the tax returns, even if their benefits are subject to conditions or terms, or if they have no control nor capacity to dispose of the assets, independently of whether they have title or possession over the assets.

The above provisions for determining the taxable base only apply to the tax on equity and cannot be applied to other taxes.

- EXPRESS PROHIBITION OF CONCURRENT TAX BENEFITS

A single economic event must not give rise to more than one tax benefit for the same taxpayer, except when the Law expressly allows it.

If a taxpayer uses multiple tax benefits for the same economic event, the taxpayer will lose the largest benefit, without prejudice for additional penalties due to inaccuracy.

The following are considered concurrent tax benefits:

- Deductions authorized by law that are not directly related to income generation;

- Tax credits;

- Exempt income;

- Income that is neither taxable income nor capital gains; or

- A reduction in the income tax rate.

This does not apply to work-related income and legal or regulatory income.

- SPECIAL TAX REGIME

- The term for certifying fulfillment of requirements for belonging to this regime was extended to up to six months.

- When the Tax Administration verifies that the information defined in the Statute has not been reported, or that the other requirements established for the process of qualifying for the Special Tax Regime have not been fulfilled, the applicant will be informed that the requirements were not fulfilled within a term of ten (10) business days from the date when the request was filed, to allow the applicant to make the appropriate corrections within one month from the date on which the notice was sent. If the taxpayer does not fulfill the requirements within the term established in this provision, the entity will not be registered in the Single Tax Registry (RUT, by its acronym in Spanish) as a taxpayer of the Special Tax Regime, and will continue to belong to the ordinary tax regime, and the Special Administrative Unit of the National Tax and Customs Administration (DIAN) will turn down the request by means of an administrative notice, against which a motion for reconsideration may be filed.

- SIMPLE REGIME

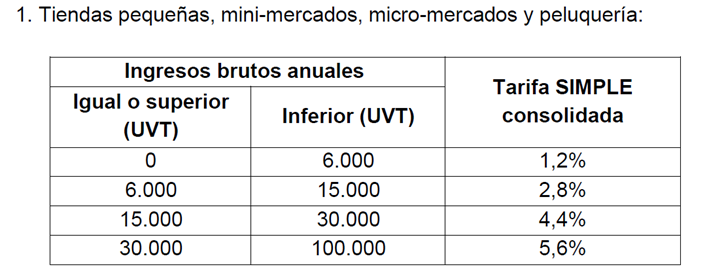

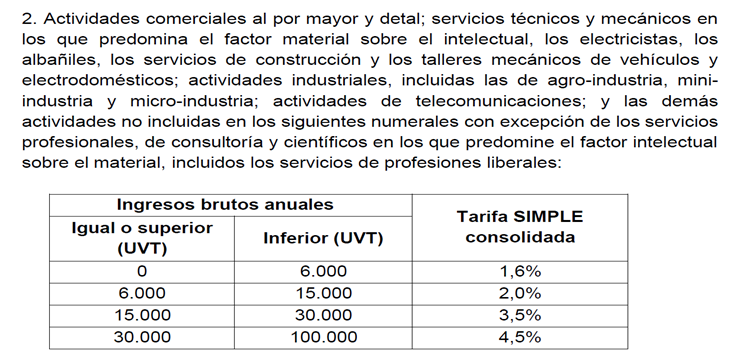

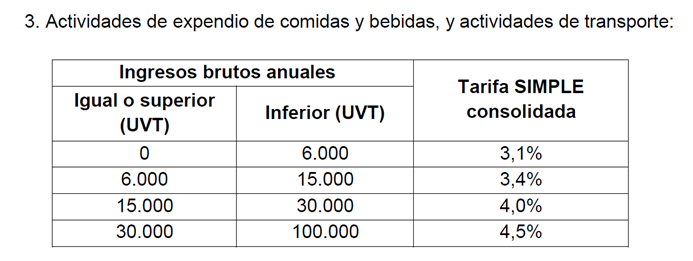

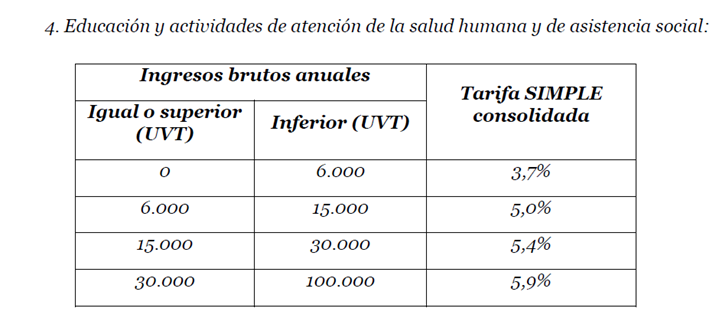

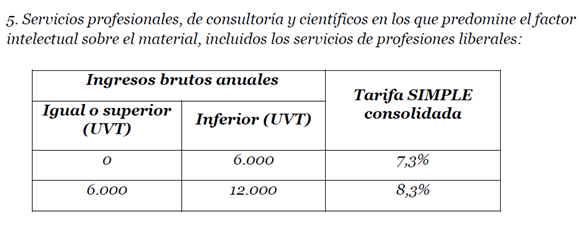

- The rates of the Simple regime are reduced as follows:

- The following health activities were included:

- Access to the regime is limited for professional services as follows:

- Individuals belonging to the Simple Tax Regime (SIMPLE) with revenues of less than 3,500 UVT (COP 148,400,000) are only required to file one consolidated annual tax return and payment, and are not required to make prepayments, through the SIMPLE electronic receipt.

- The taxpayer has the mutually exclusive choice of either taking the electronic payments discount, or to take as tax credit the tax on financial transactions effectively paid during the respective tax year, regardless of whether or not such payments are directly related to the Taxpayer’s economic activity, as long as the payments are duly certified by the withholding agent and the amount is not greater than 0.004% of the taxpayer’s net revenues. This tax credit must not be greater than the tax payable by the taxpayer belonging to the Simple Tax Regime (SIMPLE), and the consolidated portion payable for municipal tax (industria y comercio) cannot be covered with this tax credit.

- NATIONAL TAX ON SINGLE-USE PLASTICS USED AS CONTAINERS OR PACKAGING FOR GOODS

- Single-use plastics are those that have been conceived, designed or introduced in the market to perform a single circuit, rotation or use over their life cycle, independently of whether the consumer uses them more than once. They are designed to be used only once and have a short useful life, where useful life is defined as the average time during which the product fulfills its purpose.

- The taxable event is the sale, withdrawal for own consumption, or import for own consumption, of single-use plastics used in containers or packaging for goods.

- The tax accrues on the sales made by the producer on the date the invoice is issued; on the withdrawals for own use by the producers on the date of the withdrawal, and on imports on the date on which the goods complete customs clearance.

- The taxable person and person responsible for the tax is the producer or importer, as the case may be.

- The taxable base of the tax is the weight in grams of the single-use plastic container or packaging.

- The tax rate is 0.00005 UVT per each one (1) gram of container or packaging.

- EXCISE TAX ON ULTRA-PROCESSED SUGAR-SWEETENED BEVERAGES

- This tax becomes effective starting on November 1, 2023.

- Taxable event: The wording approved by the joint 3rd commissions of the Senate and Chamber of Representatives was maintained, which establishes as taxable event the production, sale, removal from inventories or acts that represent transfer of title, whether or not free of charge, and the import of ultra-processed sugar-sweetened beverages.

- An ultra-processed sugar-sweetened beverage is defined as a liquid whose alcohol content in terms of volume is not greater than 0.5% vol., and to which any sugar has been added.

- This definition covers sodas or carbonated beverages, malt-based beverages, tea or coffee type beverages, fruit-based beverages in any concentration, fruit soft drinks, juices and nectars, energy drinks, sports drinks, soft drinks, flavored waters and powder mixes.

- It also covers concentrates, powders and syrups of flavor essences or extracts that enable obtaining flavored drinks and products with or without sweeteners or flavorings, natural, artificial or synthetic, added or not, of juice, pulp or nectar or fruits or vegetables and other food additives, as well as mixes based on flour, cornstarch, malt extract and starch.

- Added sugars are defined as the monosaccharides and/or disaccharides that are added during food processing or that are packaged as such, and include those contained in syrups, and those naturally present in honey and/or in fruit or vegetable concentrates. Sweeteners that do not contain calories are not considered added sugars.

- Based on these definitions, the products under the following tariff headings will be taxed: (Tariff headings 04.03 and 04-9 were excluded.)

| Producto | Partida arancelaria |

| Extracto de malta; preparaciones alimenticias de harina, grañones, sémola, almidón, fécula o extracto de malta, que no contengan cacao o con un contenido de cacao inferior al 40% en peso calculado sobre una base totalmente desgrasada, no expresadas ni comprendidas en otra parte; preparaciones alimenticias de productos de las partidas 04.01 a 04.04 que no contengan cacao o con un contenido de cacao inferior al 5% en peso calculado sobre una base totalmente desgrasada, no expresadas ni comprendidas en otra parte. | 19.01 (excepto 19.01.90.2000 y 19.01.20.00.00) |

| Jugos de frutas u otros frutos (incluido el mosto de uva y el agua de coco) o de hortalizas, sin fermentar y sin adición de alcohol, incluso con adición de azúcar u otro edulcorante | 20.09 |

| Extractos, esencias y concentrados de café, té o yerba mate y preparaciones a base de estos productos o a base de café, té o yerba mate; achicoria tostada y demás sucedáneos del café tostados y sus extractos, esencias y concentrados. | 21.01 |

| Agua, incluidas el agua mineral y la gaseada, con adición de azúcar u otro edulcorante o aromatizada, y demás bebidas no alcohólicas, excepto los jugos de frutas u otros frutos o de hortalizas de la partida 20.09. | 22.02 |

| Preparaciones compuestas cuyo grado alcoholico volumétrico sea inferior o igual al 0,5% vol para la elaboración de bebidas | 2106.90.21.00 y 2106.90.29.00 |

- Donations of ultra-processed sugar-sweetened beverages are not taxable events when made by the producer or importer to food banks incorporated as non-profit entities under the Special Tax Regime or food banks under the same legal entity as a church or religious organization recognized by the Ministry of the Interior or by law.

- The taxable person responsible for the tax is the producer and/or the importer, as the case may be. In this case, the related parties of each are excluded from this tax.

- Additionally, this tax will not accrue in the case of producers who are individuals and whose gross revenues during the previous or current tax year derived from activities subject to this tax were less than 10,000 UVT. Once this amount is exceeded, the individual will be subject to the tax on ultra-processed sugar-sweetened beverages starting on the following tax year.

- The taxable base for calculating the tax continues to be the sugar content in grams (g) per each 100 milliliters (100 ml) of the beverage, or its equivalent, sold by the producer or imported by the importer.

- However, the following clarifications are made for determining the tax base in the case of concentrates, powders, mixes and syrups, in the sense that the base will be calculated on the sugar content in grams (g) per each 100 milliliters (100 ml) of beverage, or its equivalent, that the packaging or container certifies that can be made from the respective mix or dilution.

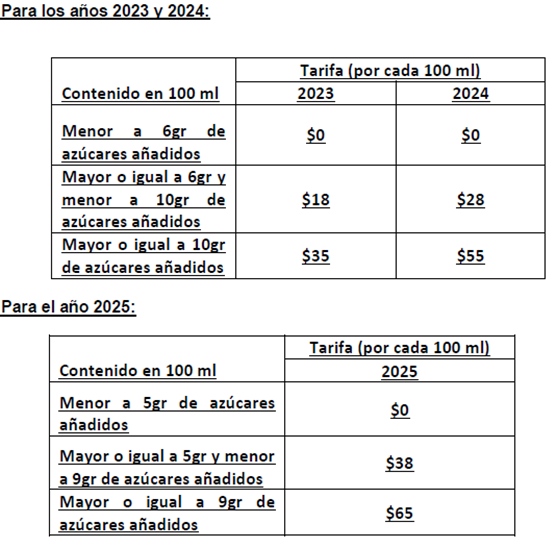

The following rates are foreseen for tax years 2023 to 2025.

However, the following formula is added to determine the tax amount that applies to each beverage:

TAX = 𝑉𝑜𝑙 100 ∗ Rate

Where:

- TAX: Is the tax amount that applies to the beverage, in pesos.

- 𝑉𝑜𝑙: Volume of the beverage, in terms of milliliters (ml).

- Rate: The tax rate, as established in the table above.

Starting in 2026, the rates established for tax year 2025 will be adjusted each January 1 in the same percentage as the increase in the Tax Value Unit (UVT). The Special Administrative Unit of the National Tax and Customs Administration (DIAN) will issue by means of an administrative act the percentage increase of the Tax Value Unit (UVT) and the value of the updated rates.

However, it should be noted that the approved reform maintains the deductibility of this tax for the effects of income taxes, because it is considered a higher value of the good; however, it cannot be offset for the effects of the value added tax (VAT).

- EXCISE TAX ON ULTRA-PROCESSED FOOD PRODUCTS

- This tax becomes effective starting on November 1, 2023.

- Below we will present the most relevant aspects of this new excise tax, which has passed the upper and lower house conciliation procedures in Congress, which implies that the text submitted to presidential approval is considered final.

- The taxable event for industrially ultra-processed food products and/or with high content of added sugars is its production, sale, withdrawal from inventories or acts that imply transfer of ownership, whether or not free of charge, and the imports of such products.

- The goods subject to the tax are those under the following tariff headings, whenever such ultra-processed food products contain added sugar, salt/sodium and/or fat, and their content is greater than the following values:

| Producto | Partida arancelaria |

| Productos constituidos por los componentes naturales de la leche, incluso con adición de azúcar u otro edulcorante, no expresados ni comprendidos en otra parte; excepto el arequipe y/o dulce de leche

|

04.04.90.00.00 |

| Embutidos y productos similares de carne, despojos, sangre o de insectos; preparaciones alimenticias a base de estos productos. | 16.01 |

| Las demás preparaciones y conservas de carne, despojos, sangre o de insectos. | 16.02 |

| Artículos de confitería sin cacao (incluido el chocolate blanco). | 17.04 |

| Chocolate y demás preparaciones alimenticias que contengan cacao. | 18.06 |

| – Mezclas y pastas para la preparación de productos de panadería, pastelería o galletería, de la partida 19.05 | 19.01.20.00.00 |

| Productos a base de cereales obtenidos por inflado o tostado (por ejemplo: hojuelas o copos de maíz); cereales (excepto el maíz) en grano o en forma de copos u otro grano trabajado (excepto la harina, grañones y sémola), precocidos o preparados de otro modo, no expresados ni comprendidos en otra parte. | 19.04 |

| Productos de panadería, pastelería o galletería, incluso con adición de cacao; hostias, sellos vacíos de los tipos utilizados para medicamentos, obleas para sellar, pastas secas de harina, almidón o fécula, en hojas, y productos similares. Excepto el pan y las obleas | 19.05 |

| Las demás hortalizas preparadas o conservadas (excepto en vinagre o en ácido acético), sin congelar, excepto los productos de la partida 20.06. | 20.05 |

| Hortalizas, frutas u otros frutos o sus cortezas y demás partes de plantas, confitados con azúcar (almibarados, glaseados o escarchados). | 20.06.00.00 |

| Confituras, jaleas y mermeladas, purés y pastas de frutas u otros frutos, obtenidos por cocción, incluso con adición de azúcar u otro edulcorante. excepto el bocadillo de guayaba | 20.07 |

| Frutas u otros frutos y demás partes comestibles de plantas, preparados o conservados de otro modo, incluso con adición de azúcar u otro edulcorante o alcohol, no expresados ni comprendidos en otra parte. | 20.08 |

| Preparaciones para salsas y salsas preparadas; condimentos y sazonadores, compuestos; harina de mostaza y mostaza preparada. | 21.03 |

| Helados, incluso con cacao. | 21.05 |

| Preparaciones alimenticias no expresadas ni comprendidas en otra parte. | 21.06 (excepto 21.06.90.21.00 y 21.06.90.29.00) |

The definition of the taxable person for this tax continues to be the producer and/or importer, as the case may be.

- As in the case of the tax on sugar-sweetened beverages, this tax will not accrue in the case of producers who are individuals and whose gross revenues during the previous or current tax year derived from activities subject to this tax were less than 3,500 UVT. Once this amount is exceeded, the individual will be subject to the tax on industrially ultra-processed food products and/or with high content of added sugar starting on the following tax year.

- The taxable base for this tax is as follows:

-

- In the case of donations or withdrawals from inventories, the taxable base is the commercial value, as defined in article 90 of the Tax Statute.

-

- In the case of imports, the taxable base for calculating the tax on ultra-processed food products and/or with high content of added sugar will be the same base used to calculate customs taxes, increased by the value of such taxes.

-

- In the case of end products manufactured in a free trade zone, the taxable base will be the sum of all production costs and expenses as indicated in the integration certificate, plus the value of customs taxes. When the importer is the buyer or client in the national customs territory, the taxable base will be the amount of the invoice plus the customs taxes.

-

- Lastly, regarding the tax rate, the approved bill establishes that it will increase gradually, as follows: Ten percent (10%) in 2023, fifteen percent (15%) in 2024 and twenty percent (20%) starting in 2025.

-

- As in the case of the tax on sugar-sweetened beverages, this tax will be considered a deductible cost from income tax because it represents a greater value of the good, in the terms of article 115 of the Tax Statute, but the tax cannot be offset for the effects of the value added tax.

- STAMP TAX

The stamp tax accrues when documents are formalized as public deeds, along with the registration tax, except in the case of the disposal in any manner of real estate properties whose value is less than twenty thousand (20,000) UVT (COP 848,000,000) and that have not been subject to this tax, or ships, or the establishment or cancellation of mortgages thereon. In the case of open-end mortgages, the tax will be paid on the respective debt documents.

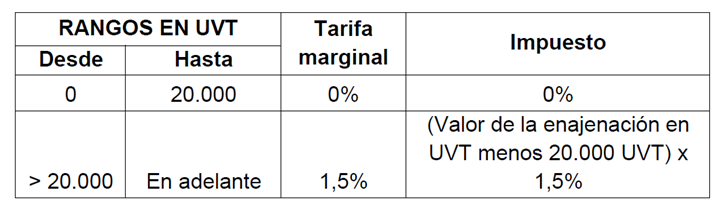

- Starting in 2023, the tax rate for documents that are formalized as public deeds in the case of the disposal in any manner of real estate properties whose value is equal to or greater than twenty thousand (20,000) UVT will be according to the following table:

- EXCLUSION FROM VAT OF IMPORTS THROUGH POSTAL TRAFFIC IN COUNTRIES WITH FTAs

Provisions are clarified for the import of goods through postal traffic, overnight deliveries, or courier services whose value is less than two hundred dollars (USD 200), which must be in accordance with the provisions of each Free Trade Agreement, and it clarifies that the FTA must expressly establish that such deliveries will not be taxed.

- PENALTIES FOR NOT REPORTING

The penalty for not reporting is reduced, and the principle of favorability can be applied. The penalties will be as follows:

Individuals and entities required to report tax information, and those who have been requested to provide information or evidence, and who fail to provide it, or fail to provide it within the term established to this effect, or when the contents thereof contain errors or do not fulfill the requirements, will incur in the following penalties:

- A fine that will not be greater than seven thousand five hundred (7,500) UVT, which will be assessed based on the following criteria:

-

- One percent (1%) of the amounts regarding which the required information was not provided;

- Zero point seven percent (0.7%) of the amounts on which erroneous information was provided;

- Zero point five percent (0.5%) of the amounts on which the information was submitted extemporaneously;

- When it is not possible to establish the base for the penalty or when the information does not have an amount, the penalty will be zero point five (0.5) UVT for each piece of information that was not provided or provided incorrectly, which must not be greater than seven thousand five hundred (7,500) UVT.

Those required to report may voluntarily correct the errors before the Tax Administration issues a statement of objections, in which case they must calculate and pay the corresponding penalty described in item 1) of this article, reduced to ten percent (10%).

When missing or inaccurate information is reported in different forms or is included in a different report, for the effects of calculating the penalty described in this article, the penalty will be assessed on the omission or error that represents the highest amount.

- Taxpayers that have incurred in the breaches described in this article, and that have not received notice of a statement of objections, will be able to correct or cure the information by submitting it by April 1, 2023, applying the penalty of paragraph 1 reduced to five percent (5%).

- BENEFIT ON PENALTY FOR NOT FILING AND ON THE INTEREST RATE FOR TAX OBLIGATIONS AND WITH THE UGPP

- It applies to taxpayers that have failed to file their tax returns and that file and pay by May 31, 2023, or that sign a payment agreement by June 30, 2023. The penalties and interest will be calculated in the following terms:

-

- The penalty for late filing will be reduced by sixty percent (60%) on the amount established in accordance with articles 641 and 640 of the Tax Statute.

-

- The late charge interest rate will be reduced by sixty percent (60%) on the interest rate established in article 635 of the Tax Statute.

- The benefits will also apply to taxpayers that correct tax returns that contain inaccuracies in the taxes managed by the Special Administrative Unit of the National Tax and Customs Administration (DIAN).

- It applies to those who have been given notice of the requirement to file and/or correct tax returns, of statements of objections, of official statements of balances due, of a resolution of penalty or ruling on a petition for reconsideration, or of the penalties proposed or determined by the UGPP pursuant to sections 1, 2, 3 and 4 of article 179 of law 1607 of 2012. Regarding the above, if the full amount of the administrative act is paid by June 30, 2023, the proposed or determined amount, including its respective update, will be reduced to twenty percent (20%). For proceedings currently in progress or those that are initiated after the effective date of this law, when the intention is to receive the reduction described in this paragraph, as long as the full amount of the administrative act is paid, a payment facility may be signed by June 30, 2023, at the latest, and the request to this effect must be filed by May 15, 2023. The above shall be in accordance to be procedure established to this effect by the UGPP.

- BENEFITS FOR PAYMENT OF OVERDUE OBLIGATIONS

- It is possible to sign payment agreements for up to one year without the need to provide guarantees.

- The tax interest rate for paying obligations that are paid before June 30, 2023 is reduced to one-half of the interest rate defined in the Tax Statute.

- RESCINDED

- The possibility of deducting employer contributions to voluntary pension funds was rescinded.

- The specific destination of the carbon tax was rescinded.

- Income on the sale of shares listed on the securities exchange continues to be considered non-taxable income, but the limit for non-exempt shareholdings was reduced from 10% to 3%.

- All the incentives for the film sector were maintained, except the 165% deduction granted to companies that are subject to the income tax for donating funds to projects in this sector.

- The presumed costs of the coffee sector were maintained.

- The incentives to libraries were not rescinded.

- The deduction for donations for investment in research, technological development and innovation was rescinded.

- The tax credit for investments in research, technological development or innovation was not rescinded.

- All income exemptions of the orange economy were rescinded.

- All incentives for mega-investments were rescinded.